Adp w4 calculator

Afraid You Might Owe Taxes Later. Figure out which withholdings work best.

3 Form For 3 3 Precautions You Must Take Before Attending 3 Form For 3 W2 Forms Template Printable Printable Job Applications

Ad Keep More Of Your Money Now.

. This tax calculator helps you determine just how much withholding allowance or added withholding should be reported in your W4 Form. Your W-4 impacts how much money you receive in every paycheck your potential tax refund and it can be changed anytime. 28 2018 the IRS released a revised Form W-4 Employees Withholding Allowance Certificate for 2018 as well as an online.

Dont Just Hand It Over Only to Get It Back With Your Return. Salary Paycheck Calculator-By ADP. W4 calculator A new W4 has been issued by the IRS.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Important Note on Calculator. It is very different from the one you are used to.

Use ADPs Florida Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The W-4 calculator can help you adjust your withholdings to determine if youll get a refund or a balance due come tax time. Important Note on Calculator.

If youve seen a copy of the 2020 Form W-4 youve probably noticed that there are no longer any withholding allowances. Estimate your paycheck withholding with our free W-4. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate.

Ask your employer if they use an automated. Divide this number by the gross pay to determine the. Frequently asked questions about the 2020 Form W-4.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. W4 calculator A new W4 has been issued by the IRS. Calculate how much your wages are after taxes.

This link calculates gross-to-net to estimate take-home pay in all 50 states. Our free salary paycheck calculator. To change your tax withholding amount.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W-4.

Once youre happy with your projected outcome the W-4 calculator. Are You Withholding Too Much in Taxes Each Paycheck. The calculator on this page is designed to provide general guidance and estimatesIt should not be relied upon to calculate exact taxes payroll or other financial.

Just enter the wages tax withholdings and other information required. Important Note on Calculator. IRS tax forms.

Use our W-4 calculator. 28 2018 the IRS released a revised Form W-4 Employees Withholding Allowance Certificate for 2018 as well as an online. Please click on the link above and use the tool to figure out how to.

Pin On Excel Templates

Pin On Ios 15 Home Screen Ideas

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Pin On Ios 15 Home Screen Ideas

Pin On Deti

App Icons Blue Lagoon Blue Tones Scheme Colors Sky Blue Etsy Iphone Home Screen Layout App Icon Iphone Apps

Pin On Excel Templates

Tax Withheld Calculator Clearance Stores 52 Off Aarav Co

How To Calculate Federal Income Tax

Pin On Excel Templates

Pin On Ios 15 Home Screen Ideas

Pin On Great Fantasy Resources

Irs 2020 Form W 4 Employer Guide Adp

The Basics Hotel Points Bank Rewards Airline Miles

Pin On Ios 15 Home Screen Ideas

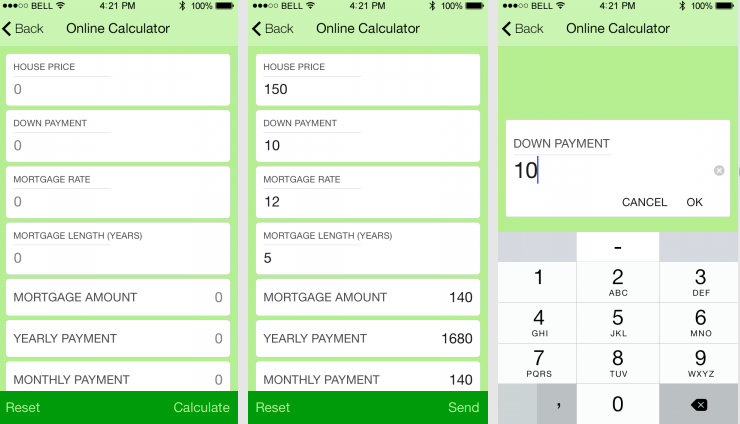

Create Your Own Adp Tax Payroll Hourly Paycheck Calculator App

Pin On Great Fantasy Resources